Vietnamese-branded products account for an average of 17% of items searched for on e-commerce platforms in 2020 and the first half of 2021, and continue to show signs of decline. What led to this worrying situation?..

Illustration

The 2021 E-commerce white paper says that up to 49.3 million Vietnamese consumers are participating in online shopping, the highest rate in the region. E-commerce and online transactions have become a bridge for people to access products for daily necessities in the context of the epidemic, social distancing, etc.

VIETNAMESE PRODUCTS “FLEXIBLE” ON E-TRADE FLOOR

Based on the analysis results of nearly 1 million clicks on the iprice.vn platform in the past 12 months, the report of iPrice (a product search and price comparison tool in 7 ASEAN markets) shows the difference. between Vietnamese-branded products versus foreign-branded products on the four most popular multi-industry e-commerce platforms, namely Shopee Vietnam, Lazada Vietnam, Tiki and Sendo.

While foreign brands have boosted sales on e-commerce platforms, domestic businesses are still struggling to take advantage of this distribution channel.

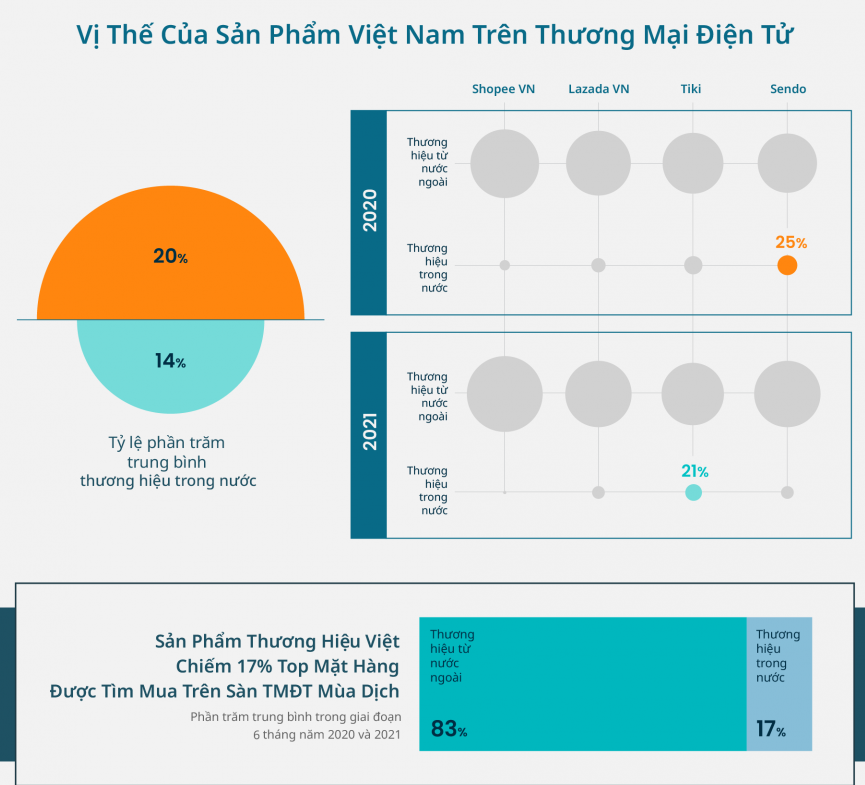

When researching the top items purchased from e-commerce platforms by counting the number of searches and clicks on products, iPrice discovered that Vietnamese-branded products only account for 17% of the items on average. goods are searched for on e-commerce floors in 2020 and the first half of 2021. In contrast, up to 83% of the most interested products on exchanges are imported goods.

More worrying is that this number also shows signs of decline from 2020 to 2021. Specifically, the percentage of Vietnamese-branded goods in the top 1200 best-selling products accounted for only 20% during the 2020 epidemic, when comparing between exchanges, Vietnamese brands are searched for the most on e-commerce platform Sendo with 25% of 300 popular products are Vietnamese products, followed by Tiki (23%), Lazada Vietnam (18%) and Shopee Vietnam (13%).

The position of Vietnamese products on the e-commerce platform (Source iPrice)

However, in the first half of 2021, domestic branded products only account for 14% of products sought by consumers. This fact showed a clear decline compared to the previous year. Leading in this index among exchanges in 2021 continues to be two domestic exchanges Tiki (21%) and Sendo (16%).

The fact that the two domestic exchanges Sendo and Tiki ranked highest in terms of Vietnamese goods in best-selling products partly shows the active support of these two exchanges for Vietnamese businesses. To date, Tiki is the only one of the four that requires all sellers to have a business license. This regulation reduces the number of sellers specializing in importing foreign goods for resale and creates more favorable conditions for domestic enterprises. Meanwhile, Sendo made its mark in 2021 with the program of Vietnamese stalls in collaboration with the Ministry of Industry and Trade and promotion of agricultural products from provinces across the country on the floor during the epidemic season.

A good point is that Vietnamese goods are selling well in the online department store, accounting for a high proportion on the two domestic exchanges. Sendo has up to 81% of products of domestic manufacturers and this figure on Tiki is 63%.

The iPrice report noted that the best-selling products on the two domestic exchanges also included agricultural and specialty products, accounting for 27% of the best-selling products. This shows that specialty products and agricultural products on the online environment are also gradually getting more attention from consumers.

MULTIPLE BUSINESSES ONLY BASED ON THE COMMUNICATION CHANNEL, “Forgetting” E-COMMERCE PLATFORMS

Mr. Nguyen Dac Viet Dung, Chairman of Sendo, said that based on experience, the rate of nearly 20% reflects the reality. “If anyone thinks that Vietnamese goods are “inferior” due to poor quality, because consumers do not support, I disagree. Vietnamese goods do not lack strong and popular brands, especially in the FMCG and fashion industries.

Sharing with VnEconomy, a representative of Sendo said that the main reason for this situation is not because Vietnamese goods are of poor quality or consumers do not use Vietnamese goods, but because Vietnamese manufacturing units and enterprises have not yet used Vietnamese goods. pay due attention to promoting sales on e-commerce channels. There are many manufacturing enterprises in Vietnam, even large ones often rely on traditional sales channels, stores, supermarkets, etc., but have not yet paid attention to e-commerce channels.

“We have met many units that completely rely on traditional retail, until the break due to Covid-19 struggled to go on the floor.” Meanwhile, with the development of cross-border sales, goods from other countries are gradually dominating the online market share in many categories. Compared with foreign goods, Vietnamese goods on the online channel are going after 4-5 years, Mr. Dung said.

This is one of the main reasons why Vietnamese products lag behind foreign brands. From this fact, some experts believe that Vietnamese brands seem to be underdogs on this shopping channel, causing domestic enterprises to face the risk of losing many important opportunities to overcome difficulties and develop post-translational development.

A representative of Sendo said that if before the epidemic, e-commerce was important, now it is ten times more important. In the past 3 months, the demand for fresh food products on Sendo has increased by 300%. People’s lives are now associated with e-commerce, sales businesses also rely on this channel. Even a company as old as Thuong Dinh Shoes, 35% of retail sales today come from e-commerce platforms.

E-commerce is considered a fertile ground for businesses to recover from the epidemic, thereby leading to economic recovery, creating jobs, but the game is dominated by foreign goods.

However, the “golden opportunity” is still ahead and the next 6 months will determine the resilience of Vietnamese businesses. In the next 6 months, when the society gradually recovers, shopping demand returns before Tet, which is the “golden time” for Vietnamese enterprises to increase market share and increase revenue to compensate for the past few months.

According to some experts, the fact that domestic exchanges facilitate Vietnamese goods is one thing, but for Vietnamese goods to be more popular on e-commerce, it needs to come from the efforts of domestic enterprises themselves. If the epidemic is complicated, production enterprises are not prepared in advance, it is difficult to have a sales channel.

On the other hand, consumers are now used to buying goods on e-commerce channels and platforms and this will continue to remain even after the epidemic passes. If businesses do not sell on e-commerce platforms, they will miss an opportunity.

Source: vneconomy.vn